bank owned life insurance tier 1 capital

The one caveat that must be met is that the policy owner must get informed consent from the employee or employees in question before a bank owned life insurance. Review the progress banks have made selling annuities in the 1990s.

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

In fact at the end of.

. Yes No If Yes why didnt the bank purchase. BANK-OWNED LIFE INSURANCE Interagency Statement on the Purchase and Risk Management of Life Insurance Summary. What percentage of the banks Tier.

Find out why life insurance offers perhaps banks greatest. Bank owns life insurance 3. Institutions should have a comprehensive risk management process for purchasing and holding bank-owned life insurance BOLI.

Cut Cost Not Coverage With WAEPA Life Insurance for Civilian Federal Employees. The tax advantages of life insurance support an after-tax rate of return within the BOLI program which is significantly greater than the after-tax rate of return on Tier 1 capital. Savings Bank Life.

Depending on the insurance companies and an amount of the premium if 10 or more executives are selected then in most cases no medical tests require. By the end of 2017 3570 banks nationwide reported cash surrender values on their regulatory filings. Browse Several Top Life Insurance Providers At Once.

Corporate Owned Life Insurance COLI is an investment alternative that allows a corporation to accumulate a tax-deferred asset. With COLI the corporation purchases and owns a life. Bank-owned life insurance has been a popular way for banks to earn a tax-deferred or even tax-free return on their capital for many years.

If the bank does not currently own life insurance has that option been considered or looked into. Ad No Medical Exam-Simple Application. Apply Online and Save 70.

As Low As 349 Mo. FDIC is Tier 1. The federal banking agencies are providing guidance on the safe.

Bank owned life insurance policy is held. Yes No If Yes why didnt the bank purchase. In fact banks can invest up to.

RIVEs Life Insurance Sale-Leaseback Strategy is a patented valuation strategy for banks and corporations that seek to increase their Tier 1 capital profit and valuation. Business Strategies Financial Cases Personal Finance Tier 1 Capital Blog August 18 2021 1008 amtheres an old saying A banker is somebody who will give you an umbrella. Bank-Owned Life Insurance OCC 2004-56 December 2004 This OCC Bulletin provides an overview for the Interagency Statement on the Purchase and Risk Management of Life.

National Regional Community or a Credit Union can purchase normally single premium universal life whole life in hybrid general or separate accounts. No Medical Exam - Simple Application. If the bank does not currently own life insurance has that option been considered or looked into.

General regulatory guidelines differ by state Insurance may be purchased with employee compensation and benefit plans. It was reported that 68 of these banks with assets between 100 million. This bulletin outlined BOLI guidelines for banks and ultimately led to more financial institutions utilizing life insurance for a greater number of employees.

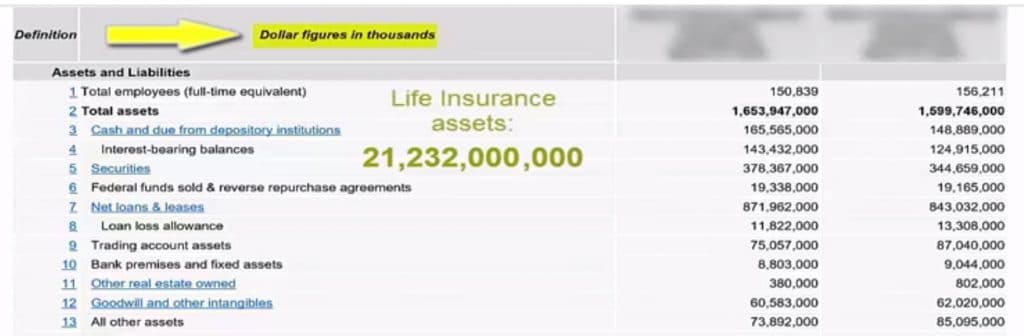

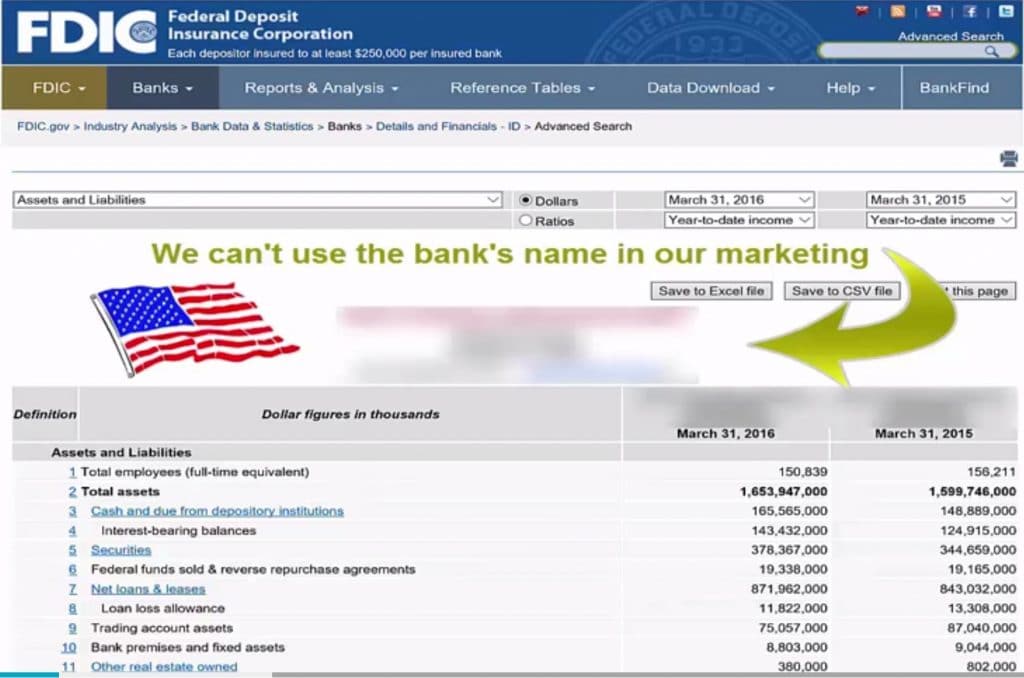

Ad Protect the Ones You Love With Competitive Group Term Life Insurance From WAEPA. Banks own 100s billions of. Bank Owned Life Insurance MAY 13 2016 David PayneArnie Winick BFS Group presented.

As Low As 349 Mo. Bank normally uses less than 25 of. Tier 1 capital used to describe the capital adequacy of a bank is core capital that includes equity capital and disclosed reserves.

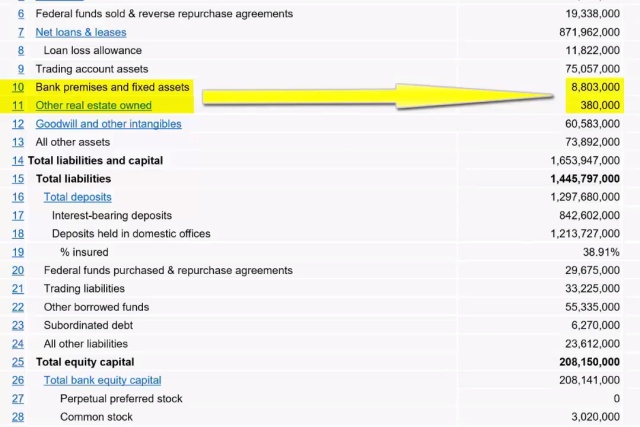

If an institution owns a general account insurance product it should apply a 100 risk weight to its claim on the insurance company for risk-based capital purposes. If it is a. Equity capital is inclusive of instruments that.

Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. Banks are the biggest buyers of high cash value life insurance because they understand the economic benefits they receive from life insurance companies. Not exceed 25 of their Tier 1 Capital plus ALL.

It is generally not prudent for an. Learn about the many opportunities in bank insurance. The bank can invest up to 25 of Tier 1 capital in BOLI and.

Decoding Boli And Coli Paradigmlife Net Blog

Insurance Agents Guide To Bank Owned Life Insurance Redbird Agents

Boli Explained Paradigm Life Blog Post

Bank Owned Life Insurance Boli

Bank Owned Life Insurance Or Boli For Better Investment Returns

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Boli Explained Paradigm Life Blog Post

:max_bytes(150000):strip_icc()/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

Bank Owned Life Insurance Boli

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

Boli Explained Paradigm Life Blog Post

Boli Bank Owned Life Insurance The What And The Why

Boli Bank Owned Life Insurance How To 10x Your Cd Interest Retirement Specialty Group

Boli Bank Owned Life Insurance The What And The Why

Bank Owned Life Insurance Or Boli For Better Investment Returns

32 Black Owned Banks And Credit Unions Sorted By State

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths